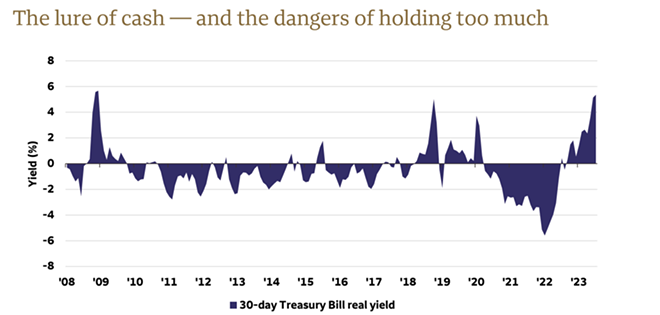

breakeven inflation rate is calculated by subtracting the real yield of the inflation linked maturity curve from the yield of the closest nominal Treasury maturity. The result is the implied inflation rate for the term of the stated maturity. Past performance is no guarantee of future results.

Real cash yields have moved into positive territory

The yield on cash alternatives has risen sharply since the beginning of 2022 as the Federal Reserve (Fed) embarked on an aggressive rate-hike campaign in an effort to combat elevated inflation. In May 2023, the yield on the 30-day U.S.

Treasury bill climbed above 5%, where it has remained. The chart shows that cash yields moved into positive territory on a real, inflation-adjusted basis after a few years of negative real yields. This shift has prompted investors to question if now is the time to increase cash holdings. However, this may have unintended consequences. Even if cash yields remain elevated in the short term, we believe cash will likely underperform other growth assets over the long term, putting a drag on long-term performance.

What it may mean for investors

We believe developing a disciplined investing approach, such as dollar-cost averaging, to invest excess cash and rebalancing to maintain targeted allocations is prudent for long-term investors, as we expect most assets to outperform cash over the long term.

Risk Considerations

Each asset class has its own risk and return characteristics. The level of risk associated with a particular investment or asset class generally correlates with the level of return the investment or asset class might achieve. Bondsare subject to market, interest rate, price, credit/default, liquidity, inflation and other risks. Prices tend to be inversely affected by changes in interest rates. Although Treasuriesare considered free from credit risk they are subject to other types of risks. These risks include interest rate risk, which may cause the underlying value of the bond to fluctuate.

A periodic investment plan such as dollar cost averaging does not assure a profit or protect against a loss in declining markets. Since such a strategy involves continuous

investment, the investor should consider his or her ability to continue purchases through periods of low price levels.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells

Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information

purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone.

Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Interested in investing and not sure where to start? Contact Christopher Noble today!

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be

afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. PM-02282025-5922520.1.1

Veronica Willis, Global Investment Strategist Excerpted from Investment Strategy (August 28, 2023)